Guangzhou, a city enjoying continuous economic prosperity for thousands of years, is the cradle of finance in modern and contemporary China. Many of today’s financial systems, institutions and instruments first appeared in Guangzhou before expanding to other parts of the country.

Back in the mid-Qing Dynasty, there had been increasingly frequent trade exchanges between China and western countries along the ancient Maritime Silk Road.

Guangzhou, known as Canton at that time, handled an overwhelming amount of cargo at ports every year, which was especially vulnerable to fire and flood hazards. Merchants started to look for insurance to cover the loss of or damage to the goods.

In 1801, several foreign trading firms in Canton reached a temporary agreement to offer compensation of up to 12,000 dollars to cargo on one ship in case of any damage or loss. The agreement was the first of its kind in China and marked the emergence of insurance in the country.

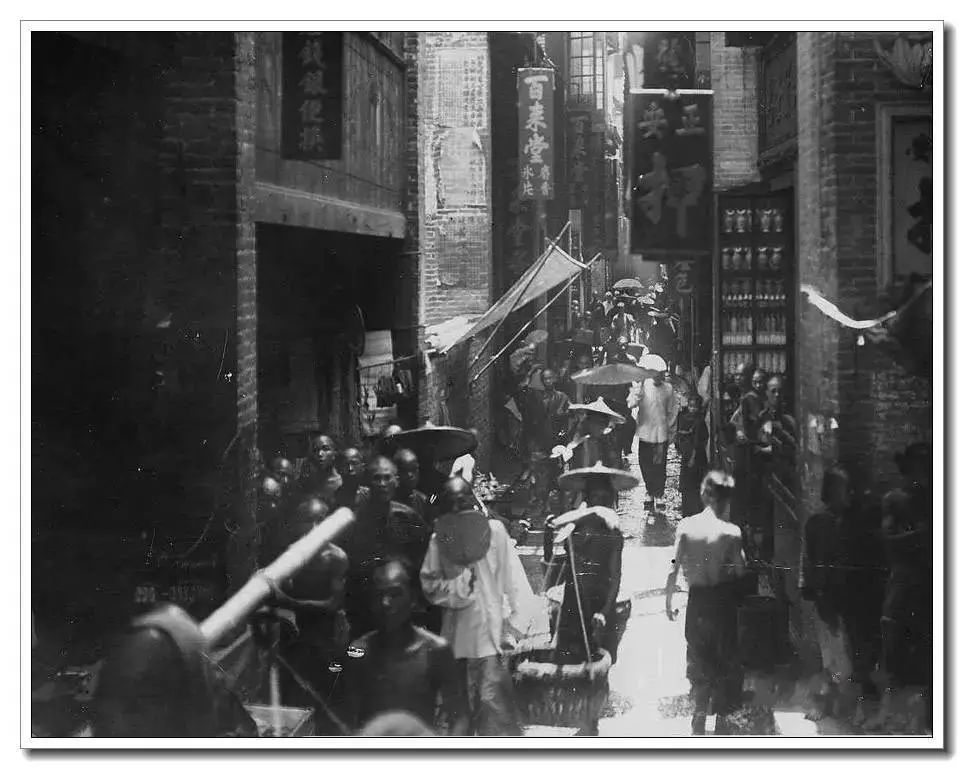

A bustling wharf in Canton, the Qing Dynasty

Four years later, Canton saw the establishment of the Canton Insurance Society, the first foreign-owned insurance company in China. Professional insurance service was officially introduced to the Chinese market.

The Society was managed by two British trading firms, namely the Dent & Co. and Jardine Matheson & Co., in turns.

It was also from Canton that the banking industry developed in China. In 1845, the Oriental Bank Corporation, a British imperial bank, opened a branch in Hong Kong and an office in Canton, which became the earliest foreign bank to enter China. It was also the first commercial bank ever set up in China.

The bank’s office in Canton was specialized in exchange business to facilitate trade among Britain, India and China at that time.

The bank expanded its operations rapidly to other Chinese cities but had to pull out of China in 1884 because of severe losses due to poor investment. Once a key player in China’s capital market, the Oriental Bank was later replaced by the Hong Kong and Shanghai Banking Corporation (HSBC).

For decades, Canton was the only port open to foreign trade during the Qing Dynasty. Foreign currencies flocked into China through Canton, which quickly held a dominant position in circulation.

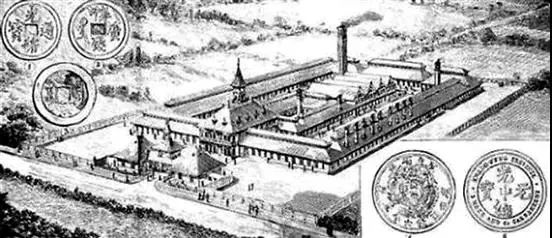

To curb the flood of foreign coins in the market, Zhang Zhidong, the then governor of Guangdong and Guangxi, proposed to the Imperial Court in 1887 to build the first modern mint in Guangdong to produce domestic coins.

China’s first modern mint was built in Canton in 1887.

Zhang’s proposal was soon approved. And the mint, named Guangdong Money Bureau, was built at Huanghua Village outside the East Gate of Canton city (now Huanghua Lu in Yuexiu district). It began operation in 1889 and introduced advanced British coinage machines for production.

Guangxu Tongbao, China’s first machine-made copper coin cast in Canton

China’s first machine-made silver coin cast in Canton, with a dragon design on the reverse.

The booming trade activities in Canton also fueled the growth of traditional financing institutions such as pawnshops, exchange shops and old-style private banks.

Haopan Jie (Street), located to the south of Canton city, had been a famous marketplace since the Song Dynasty (960-1279AD), where one could find all kinds of novel products from home and abroad. Merchant groups from across the country were attracted by the business environment there and set up an array of merchant houses, guild halls, shops and banks on the street.

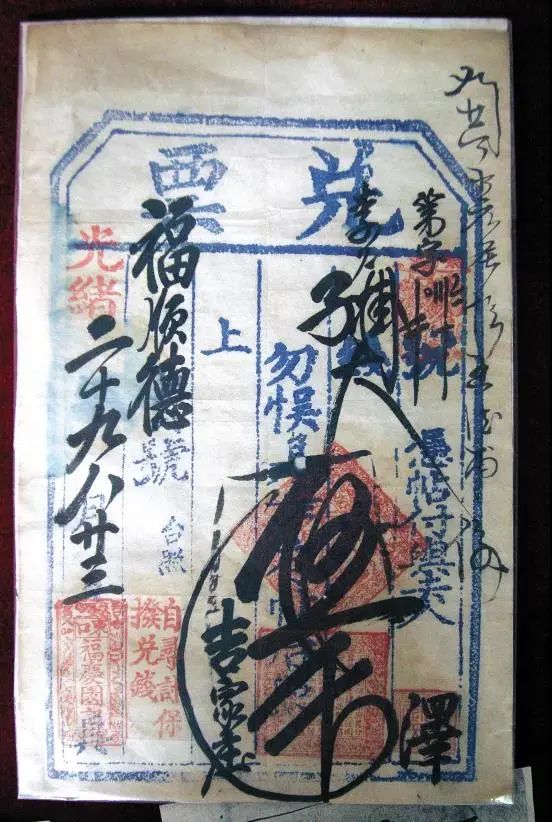

A draft issued at a bank in Canton, the Qing Dynasty

Bank draft was a convenient and secure instrument which saved the efforts of transporting heavy silver ingots.

During the Qing Dynasty, Shanxi merchants from northern China almost took over the street with dozens of draft banks they owned, which received deposits from and offered loans to individuals and enterprises as well as provided exclusive exchange services to the government.

At that time, Canton handed over tons of silver as official funds to the Court every year, with an average value between 700,000 and one million liang (tael). The silver was often exchanged for drafts at the banks on Haopan Jie for easier transportation.

The ubiquity of various types of financial institutions and their huge transaction volume made Haopan Jie the ‘Wall Street’ of Canton and the financial center of the city.

From the mid-Qing Dynasty to the era of the Republic of China (1912-1949), Canton’s pawnbroking industry reached its heyday. The city was claimed to have more pawnshops than rice stores during the period.

In 1934 alone, the number of pawnshops in Guangdong hit 1,276, 525 of which were located in Canton.

Financial institutions of various types were everywhere on the streets of Canton in the Qing Dynasty.

Canton also boasted more than 500 old-style private banks in the modern era, the most in the country. Such banks offered many of the same services as draft banks. Some large private banks would even issue bank notes.

Over the past centuries, Canton had been influential in pooling capital and spurring economic growth. Finance is deeply rooted in the city’s DNA. Today, Guangzhou maintains its edge and remains at the forefront of pursuing high-quality development of finance.

SOURCE: lifeofguangzhou.com,丝路云帆